KapiCore.cloud is a new global cloud, offering banks of any size and location, access into our cloud-ready, Core Capital Markets platform Launching soon – Stay tuned!

KapiCore.cloud is a new global cloud, offering banks of any size and location, access into our cloud-ready, Core Capital Markets platform Launching soon – Stay tuned!

Enjoy SaaS efficient pricing model

Enjoy SaaS efficient pricing modelUpon KapiCore.cloud launch we will offer an attractive SaaS (Software as a Service) pricing model that eliminates large license costs and correlate usage costs to levels of activity, allowing the bank to offer clients a competitive capital markets offering.

Start small, Grow big

Start small, Grow bigBanks can initiate a smaller capital market activity facilitating our minimum cloud setup and pricing, then grow bigger upon activity expansion. As the Bank grows big, he can expand seamlessly the capacity and core configuration to support his geographic expansion and activity growth

Focus on expanding your business

Focus on expanding your businessKapiCore.cloud operates all aspects of the technology infrastructure: communication, hardware, data security Core’s software upgrades, monitoring and more, allowing the bank to focus his efforts on business expansion, reaching to more clients in more regions with new services and products

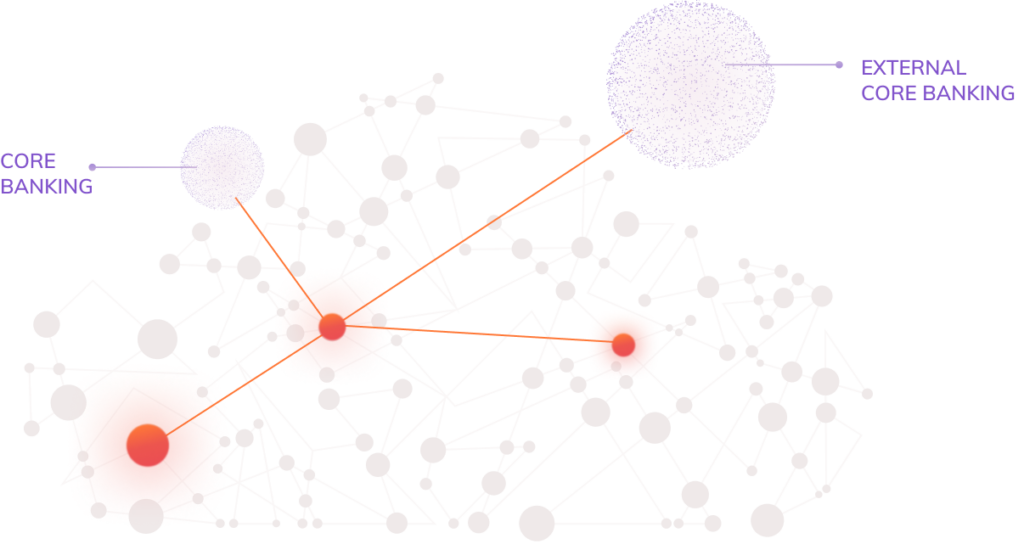

KapiCore.cloud enables banks with global and diverse geographic presence to set up a Multi-Core configuration that match its unique organization structure and needs.

Most of the leading core banking system providers offer cloud-based solutions. KapiCore.cloud provides a cost effective, seamless, integration between our Core capital markets platform and cloud-based Core Banking systems.

Cloud based cores are upgraded transparently so that the Bank always enjoys the latest functions and features.

Lead your bank to the future of capital markets Contact Us